Failed SPAC mergers increased by 320% in 2022

“They had so many comments from the SEC that they decided to call off their SPAC merger altogether,” said a friend of the Bedrock team who was involved in a recent failed SPAC merger (in an advisory capacity).

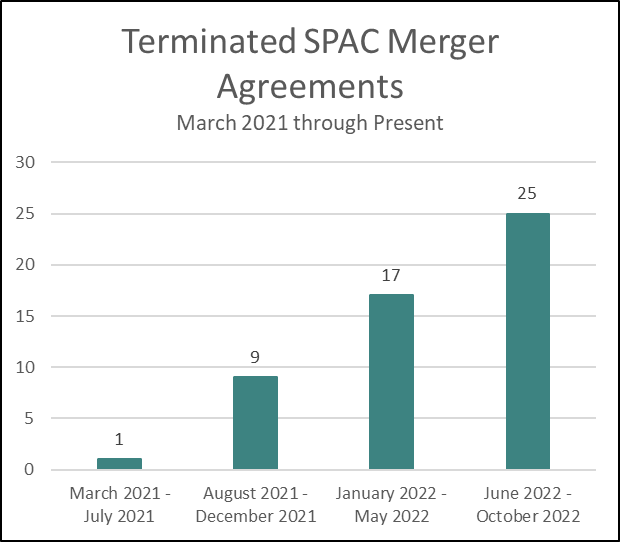

Our colleague’s experience with a terminated SPAC merger isn’t as unusual as it may seem. Many SPAC mergers seem to be collapsing. There have been 42 terminated merger agreements reported by SPACs in 2022.1 This is a 320% increase when compared to 2021 SPAC merger terminations.

And the year is not over yet.

The collapse of the stock market and the threat of recession appear to be the primary reasons for these SPAC merger failures. Investors have been withdrawing their money from SPACs and have become less optimistic about the growth prospects of de-SPACs.

Read the full post on our blog here.

However, many of these terminated agreements occurred before the more extreme stock market declines occurred. We have reason to believe that a contributing factor to the trend in failed SPAC mergers was an increase in regulatory scrutiny. As our colleague mentioned, the SEC’s review process on a particular SPAC merger became a major roadblock, leading to the deal’s demise.

The combination of the slumping market and increased regulatory requirements have not only caused the cancellations of SPAC mergers that were already in process but also slowed down SPAC IPOs in 2022.

Our team looked into terminated SPAC merger agreement trends. We reviewed the SEC filings of currently existing SPACs. There were 52 terminated SPAC merger agreements in this population from the beginning of 2021 through the present.2 We did not identify any SPAC merger terminations in the first half of 2021. The earliest termination found was in July 2021. All 52 identified SPAC merger collapses occurred within the last 16 months.

Find high impact events in securities filings, like the ones above with Bedrock AI. Sign up for a trial.

Terminations of SPAC mergers have accelerated over time. The chart below shows failed SPAC mergers over the last 20 months broken down into 5 month increments. There is notable acceleration in terminated SPAC mergers in each period.

Some recently scrapped SPAC mergers involved well-known companies like Forbes, SeatGeek, and Panera Bread.

In August 2021, Forbes Global Media Holdings Inc. announced that it would merge with Magnum Opus Acquisition Ltd. (OPA). The deal would have valued Forbes at $630 million. SeatGeek wanted to merge with RedBall Acquisition Corp (RBAC) at a $1.35 billion valuation, which was announced in October 2021. Panera Bread, which was previously valued at $7.16 billion, was supposed to merge with USHG Acquisition Corp (HUGS). Each of these deals was scrapped this past summer.

Very lucrative SPAC mergers with blockchain and crypto mining firms also fell through recently. These included a $3.6 billion deal between Goldstone Acquisition Limited (GDST) and a blockchain-based payments company, Roxe Holding, as well as a $1.25 billion merger between 10X Capital Venture Acquisition Corp II (VCXA) and a crypto mining firm, Prime Blockchain.

One SPAC, Mudrick Capital II (MUDS), ended up forgoing two SPAC merger deals: one in August 2021 with Topps Baseball Cards and another this past August with Blue Nile, a jewelry company.

A few companies gave specific reasons for canceling the proposed transactions. For example, Forbes stated that its revenue and cash flows had begun to exceed forecasts initially made when it agreed to merge with Magnum Opus. Forbes believed that its value was higher than what was proposed in the SPAC deal. Mudrick Capital Acquisition Corp II (MUDS) failed to close with Blue Nile because a competitor of Blue Nile ultimately acquired the company instead.

Most companies, however, gave vague or general reasons for their failed mergers. As many would expect, a lot of these SPACs disclosed that the deals fell through due to unfavorable market conditions. Redball Acquisition Corp (RBAC), USHG Acquisition Corp (HUGS), Sports Ventures Acquisition Corp (AKIC), Ace Global Business Acquisition Ltd. (ACBA), VPC Impact Acquisition Holdings II (VPCB), and Rosecliff Acquisition Corp I (RCLF) all cited unfavorable market conditions for scrapping their merger agreements.

The SEC’s review process on SPAC mergers

On March 30, 2022, the SEC proposed tougher rules on the SPAC sector and its transaction activities. By a 3-1 vote, the SEC proposed stricter rules on disclosure regarding conflicts of interest, insider compensation, and certain costs and equity dilution involving SPAC transactions. The proposal also included new financial disclosure requirements with respect to financial projections and fairness determinations in SPAC mergers. Clearly, after SPACs heated up the markets in 2020 and 2021, the SEC wanted to enforce more stringent disclosure and marketing standards on SPACs and de-SPACs, bringing the standards closer to what is required of all other publicly traded companies.

Since the announced proposal, Bedrock found that 29 existing SPACs called off their planned mergers. Is the SEC making things much harder for these de-SPAC transactions to close? Is regulatory scrutiny a major contributing factor for the increase in merger terminations?

To better understand why regulatory scrutiny might be slowing down the SPAC merger success rate, let’s walk through the SEC’s regulatory review process for a SPAC merger.

First, a SPAC will solicit approval from its shareholders for a merger. Then, it will prepare and file a proxy statement or a Form S-4, depending on whether it intends to register new securities from the merger. The proxy statement and/or Form S-4 describes the merger and details the financial information of the target company, including historical financial statements and pro-forma financial statements. This is then submitted to the SEC for review. The SEC then provides comments based on that review. The SPAC and target company make any necessary amendments to its draft filing to clear the SEC’s comments. The merger will close and the target company becomes a publicly traded entity only once a) the shareholders approve the planned merger and b) all of the comments from the SEC are addressed and cleared.

Several of these planned SPAC mergers may have failed because they were not successful in completing the SEC’s regulatory review process. As previously mentioned, a friend of the Bedrock team was involved in a recent failed SPAC merger. The colleague noted that the SPAC and target company received significantly more SEC comments than one would reasonably expect on their submitted Form S-4. The challenges that they faced during the Form S-4 review period led to their decision to forego the merger altogether.

Did other planned mergers deal with similar challenges? One recent terminated agreement may have indicated that there were regulatory challenges in the SPAC merger process as well. On August 8th, target company Voltus informed the Broadscale Acquisition Corp that it would be unable to complete all actions necessary to have its registration statements be effective prior to the agreement deadline. The two parties announced the termination of the merger agreement on August 12, 2022.

Voltus and Broadscale Acquisition Corp weren’t the only duo to miss a merger deadline. On July 5, 2022, FinTech Acquisition Corp V and eToro mutually terminated their merger agreement because the parties were unable to complete the deal by the June 30, 2022 deadline.

Many of the entities involved in terminated mergers did not cite any reasons for their scrapped deals. Could it be that many of these transactions failed because they couldn’t complete the SEC’s review process? Many de-SPACs have been the triggers for the increased regulatory scrutiny. As mentioned in our previous SPAC-related substack, almost 50% of de-SPAC filings since 2021 have reported ineffective internal controls. Perhaps the SEC is doubling down on its SPAC merger review process and making sure that companies that truly aren’t ready to be public are not given the green light so easily.

Interested in doing your own research on SPACs? Bedrock AI uses language based models to detect red flags on all publicly traded companies (including SPACs) filed with the SEC. Don’t have a Bedrock AI subscription? Sign up for a free trial! https://www.bedrock-ai.com/contact-us

Since January 1, 2022, there were 42 planned mergers that were originally reported by SPACs to the SEC but ultimately canceled and disclosed with a Form 8-K Item 1.02.

As of October 12, 2022.