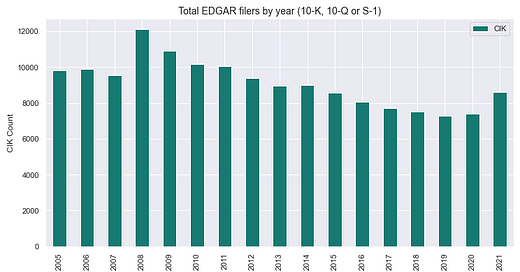

Despite a surge in SPAC IPOs, there are fewer EDGAR filers now than there were in 2010.

In 2020, we all started hearing about an explosion of companies going public, a.k.a. “SPAC Mania”. Prior to 2020, journalists bemoaned the decline in the number of publicly listed companies, depriving the average Joe of opportunities to generate passive income.

At Bedrock AI, we collect data from the EDGAR archives. EDGAR is the SEC’s public repository for public company filings. We took a look at EDGAR filer data to get a better sense of what this trend really looked like.

Although we welcomed plenty of new filers to markets in 2020, we also said goodbye to many old ones. Overall, the effect was, well, neutral.

Read the full post on our blog here.

Why did 2020 feel so huge, and what’s next in 2022?

Year 2020 was the start of the SPAC explosion. We remember - it felt like every second company on our platform was advertising their lack of operating history. The total S-1s filed (excluding amendments) in 2020 dwarfed recent years, but the 2020 “spike” doesn’t really stand out if you zoom out. The number of S-1s filed in 2020 was actually pretty typical for years going back to 1996. Note that the dramatic increase in S-1s in 2021 wasn’t entirely due to companies going public but also driven by new stock issuances from existing companies.

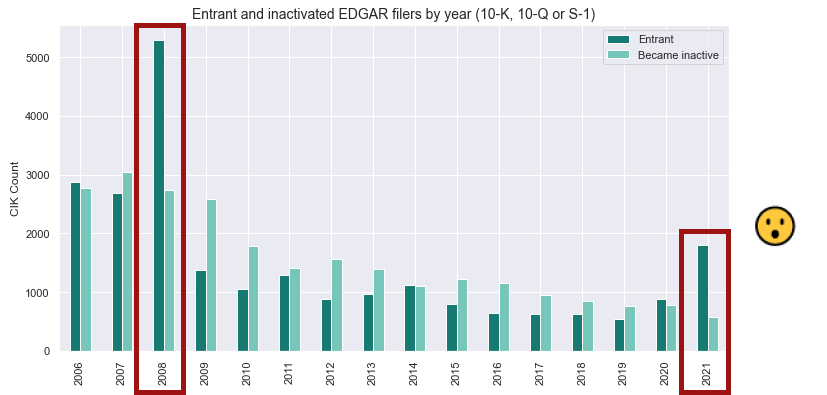

It wasn’t just the slump in new filers in the preceding years that made 2020 feel different. 2020 was the first year since 2014 that new filers outpaced filers becoming inactive during the year. We haven’t seen increases in the total number of filers for two years in a row (2020 and 2021) in well over a decade.

What’s up with 2021?

Did you do this too?

The disconnect between EDGAR entrants and inactivations in 2021 is reminiscent of 2008. Comparisons to 2008 typically aren’t happy.

It’s hard to think about that year without thinking about the financial crisis, the Lehman Brothers bankruptcy, and the Dow Jones tanking 504 points on September 15. While 2021 certainly had a few interesting days and interesting trends (wallstbets, lumber, bitcoin, tech stocks, etc…), even $HOOD halting trading of GME Jan 2021 pales in comparison to the SEC stopping all shorting of financial companies to ensure the securities market didn’t collapse in September 2008…

Was 2021 just mini-2008? Should we expect 2022 to be mini-2009?

New EDGAR entrants dropped quickly from late 2008 through 2009 which makes sense. The world was reeling from the crash - investment banks were busy rebuilding and investors weren’t feeling particularly generous.

Looking at 2021, it didn’t take a collapse of our financial markets to prompt a slow down in entrants. We could slow further, but for now we’re still outpacing 2015 to 2019 with new EDGAR entrants. The first quarter of the year is typically the busiest time for entrants so when Q1 2022 wraps up we’ll have a better sense of what’s ahead.

It will be interesting to see if newly added public companies in 2020 and 2021 have staying power. Will many of the new SPAC mergers be defunct and inactive in a few years or will the majority survive? What’s your guess?

About us: Bedrock AI extracts red flags from SEC filings based on learned associations with downside outcomes. Our institutional dashboard analyzes annual and quarterly statements, 8-Ks, prospectuses (and soon SEC comment letters) for over 7,000 tickers. We process filings and render analysis in real-time.

Connect with us on Twitter. Contact us at info@bedrock-ai.com for a demo.