It’s no secret that companies take timing into consideration when they publish a securities filing. The vast majority of 10-Ks and 10-Qs (~60%) are filed between 4 PM and 5:30 PM, after markets close but while EDGAR is still accepting filings. This gives stakeholders time to read and digest the information before markets open the next day.

Not all companies have such noble intentions. Many PR teams plan to put out bad news on Fridays after 4 PM when analysts are least likely to be paying attention. Michelle Leder of Footnoted has famously shed light on this phenomenon by combing through what she calls the “Friday Night Dump”.

Read the full post on our blog here.

Table 1: Filing times of 10-Ks and 10-Qs

If you’ve ever audited a public company or worked in-house, you’ve probably been involved in a “fire drill” ahead of a 10-K or 10-Q deadline. Maybe there’s a material subsequent event that needs to be disclosed or the audit uncovered something that needs to be explained. This leads to a mad rush to get everything completed ahead of the 5:30 PM deadline on filing day.

This mad rush doesn’t always work out. Beyond Meat had to file a non-timely form this year because they pushed the publish button just five minutes late. And Shoals Technologies Group encountered what they termed “edgarization issues” while attempting to file their most recent 10-Q right before close.

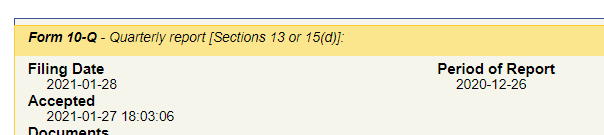

The SEC’s hours of EDGAR Operations are technically between 6:00am and 10:00pm Eastern Time. For most filing types, however, if the filing is submitted after 5:30pm Eastern Time, it will not be considered filed with the SEC until the following business day. When a filing is submitted to EDGAR after 5:30 PM on January 27th, it will have an “accepted date” of January 27th but the “filing date” will be January 28th. Hence the importance of the 5:30 PM deadline.

Some large caps like Apple and Meta ALWAYS file after hours

When we see an “accepted” time on EDGAR that’s late in the evening we often assume that it’s because of a so-called fire drill i.e. everything is not okay. This is not always the case. For some companies, filing after hours is intentional and normal.

Approximately 3 percent of large cap companies filed every single K or Q after 5:30 PM for each of the last seven quarters. Companies that follow this pattern include Apple, a company that consistently files their quarterly reports within 10 minutes of 6 PM, and other household names like Alphabet, Amazon, Meta and PepsiCo.

Consistently filing after hours is more common among large caps, presumably because they have in-house teams willing to work late and stick to a schedule. Less than 1% of small cap companies consistently file after hours.

For those that don’t, deviations indicate big news

For companies that don’t have a history of filing after 5:30 PM, late night EDGAR submissions often do indicate trouble. Bedrock AI forensic specialist, Andre Castillo, looked through the filings with accepted times after 8 PM (on any day) and found that many of these late submissions we driven by high impact events behind the scenes.

Here are a few examples:

Citigroup (9:41 PM on August 3rd): Disclosed a regulatory investigation into trading of sovereign securities, a $130M write-down on Russian bonds and a $70M asset impairment.

Nvidia (8:33 PM on March 17th): Disclosed a data hack and a terminated purchase agreement with Softbank. Nvidia’s stock price proceeded to fall over 40% after this filing.

Southwest Airlines (9:44 PM on August 1st): Reported declining margins and that flight credits would never, ever expire.

Take Two Interactive (8:16pm on May 16th): Disclosed declining net income and margins. The company was also in the midst of completing an acquisition with Zynga which closed on May 23rd.

Warner Bros. Discovery (10:01pm on August 4th): Recast its accounting numbers with new segment disclosures due to a recent merger and announced they would combine HBO Max and Discovery+.

Find high impact events in securities filings, like the ones above with Bedrock AI. Sign up for a trial.

When you see companies deviate from normal schedules, read the filing carefully

When companies deviate from their normal schedules, there’s usually a good reason. This is true not just when thinking about the time of day but also the filing date.

Consistency isn’t always good: Some companies almost NEVER file on time

In April we noted a 40% increase in non-timely filings driven primarily by SPACs. This trend has diminished since April as SPACs and de-SPACs adjust to life as public companies.

However, some companies never do seem to adjust. For instance, Vinco Ventures (BBIG) which has only filed a quarterly report on time ONCE in its life as a public company. Vinco boasts a total of 14 non-timely forms filed since going public.

Other companies that consistently file late include:

MiMedx Group (MDXG)

FuboTV (FUBO)

DXP Enterprises (DXPE)

Circor International (CIR)

African Gold Acquisition Corp (AGAC) + many other SPACs

Questions about SEC filing patterns?

Have you seen an anomaly you want us to investigate? Do you have a question about SEC filing patterns, timings and deadlines? Let us know and we’ll consider answering it in our next newsletter.

Upcoming Events:

Shortselling & forensic research: Kris and Andre will be presenting our findings on statistical relationships between qualitative disclosure and price decline for the first time in a public setting in New York City on September 29th. Vision Research and Bleecker St. will be presenting new short ideas. If you are an institutional investor, sign up to attend in person. The event is free but space is limited.

Finance & NLP: Interested in hearing Suhas discuss NLP in Finance? Suhas will be chairing and speaking at the Toronto Machine Learning Summit in NLP on September 13th. Sign up here - https://www.torontomachinelearning.com/tmls-nlp