Bedrock AI predicted stock price collapse at Coinbase, Robinhood, Peloton and more

Substack written by Andre Castillo, CPA/ABV, CFE, Head of Forensic Research at Bedrock AI.

Bedrock AI uses large language models (artificial intelligence) to find price-moving information in securities filings and predict downside risk.

Our models correctly predicted dramatic price collapses at countless companies over the past two years. Some companies worth highlighting are Coinbase Global $COIN, Robinhood Markets $HOOD, and Peloton Interactive $PTON.

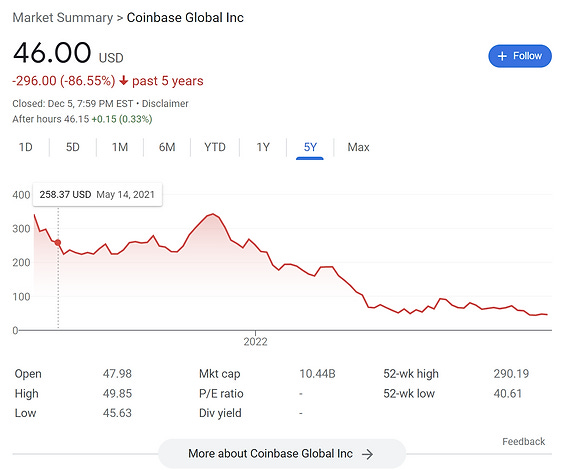

Coinbase Global COIN 0.00%↑

Our models predicted a price collapse on May 13, 2021 (date of its 10-Q filing). At the time, our algorithms gave $COIN’s a risk score of 77 (very high risk).

Since then, Coinbase’s stock price dropped from over $250 to only $42.60 (as of December 12, 2022), a decrease of over 80%.

During this same timeframe, the S&P 500 was down just 3%.

Robinhood Markets HOOD 0.00%↑

Our models predicted a price collapse on August 18, 2021 (date of its 10-Q filing). At the time, our algorithms gave $HOOD a risk score of 78 (very high risk).

Since then, Robinhood’s stock price dropped from approx. $50 down to $9.58 (as of December 12, 2022), a decrease of over 80%.

For context, the S&P 500 was down 10% over this same time frame.

Peloton Interactive PTON 0.00%↑

Our models predicted a price collapse on May 6, 2021 (date of its 10-Q filing). At the time, our algorithm gave $PTON a risk score of 77 (very high risk).

Since then, Peloton’s stock price dropped from over $80 down to $11.71 (as of December 12, 2022), a decrease of over 80%.

During this same time frame, the S&P 500 was down just 5%.

The price charts for these three companies illustrate the dramatic destruction of value over the past year+:

In addition to high Bedrock AI Risk Scores at these companies, we flagged severe red flags to our subscribers over the past two years. Never miss red flags like these again.

Red flags at these three companies identified by Bedrock AI in 2021 included (not a comprehensive list):

Coinbase Global $COIN

Related party revenue - The company recognized millions of dollars in revenue with related parties, which include its directors, executives, and immediate family members of principal owners.

High severity legal and regulatory issues - The CTFC issued and settled an administrative order against $COIN relating to violations of the Commodity Exchange Act. Coinbase also received investigative subpoenas from the SEC for information on its customer programs, operations, and intended future productions.

Highly leveraged with cash flow pressures - $COIN had over $3 billion in debt, disclosing that its “substantial indebtedness… make it difficult for us to satisfy our financial obligations.”

Robinhood Markets $HOOD

De-prioritization of financial reporting - During all of 2021, the company made no attempt to assess whether its internal controls (i.e., systems to ensure financial statements are accurate) were effective.

Board resignations - On November 11, 2021, Jan Hammer resigned from the board of directors, effective December 31, 2021.

High severity legal and regulatory issues - In April 2021, the California Attorney General’s Office issued a subpoena to $HOOD as part of an investigation into its trading platform, business and operations.

Peloton Interactive $PTON

Problems with inventory counts and logistics - Management disclosed that the internal controls related to $PTON’s inventory counting process were ineffective. Furthermore, $PTON lacked a global inventory count policy and lacked standard operating procedures for key stakeholders within the supply chain, logistics, and inventory processes.

Adverse opinion from auditors - Ernst & Young had issued an adverse opinion on the effectiveness of its internal controls.

Inventory write-offs and increase in revenue related reserves - Peloton expected to incur additional costs related to inventory write-offs and increases in its revenue related reserves (i.e., estimated product returns) primarily due to a major product recall.

Because each of these companies had accumulated qualitative red flags with severity levels higher than their market peers, our models put $COIN, $HOOD, and $PTON in the top 10% of riskiest large and mid cap companies.

Our Bedrock team also highlighted red flags at Coinbase Global in a March 2022 Substack (a month after flagging to Bedrock AI subscribers) and Peloton Interactive in an October 2021 Substack. At the time of these newsletters, $COIN’s stock price was still high at $172.53 and $PTON was riding high at $90.65.

From our October 2021 Substack (published after flagging to Bedrock AI subscribers) when $PTON was riding high at $90.65:

Bedrock AI’s Dashboard makes it easy to find qualitative red flags and assess relative severity. These red flags are assessed in real-time, without human intervention. Bedrock AI’ platform updates as soon as companies file reports to the SEC. Below is a screenshot of our Dashboard showing algorithmic red flags for Peloton $PTON from its Form 10-K filed in August 2021:

Protect your portfolio. Never miss a red flag again. Request a free trial of Bedrock AI.

Explore real-time analysis of annual and quarterly statements, 8-Ks, prospectuses, SEC comment letters and more for over 7,000 tickers. Analysis is served without human intervention. Quantamental investing is transforming the industry. Lead the way with Bedrock AI.